The Benefits Of Diversification In Equity Asset Allocation

Posted on 14th March 2024 at 22:10

Putting all your money in one stock is like loading up a single basket with every egg you own. It's risky business. If that basket tumbles, there go your eggs - your financial future - crashing to the floor.

But diversification catches those eggs in multiple baskets, minimising the mess if one falls. This time-tested investing strategy spreads your money across various stocks, sectors, and asset classes. That way, if one stumbles, the others keep moving steadily along. Your eggs stay safe.

DIVERSIFICATION WORKS ITS MAGIC IN TWO KEY WAYS:

First, it reduces your exposure to risk. With holdings spread out, you avoid tying your fate to just a few stocks. If a couple drop, you've got others to balance it out.

Second, diversification unlocks more return potential. Different investments thrive at different times. By holding an array of assets, you give yourself the chance to grab gains wherever they sprout.

Risk reduction

Enhance Returns

Smoothing Out Market Cycles

Exposure to different opportunities

Risk adjusted returns

DIVERSIFICATION IS LIKE A SHIELD AGAINST RISK FOR EQUITY INVESTORS.

By spreading your bets across different asset classes, sectors, and regions, you minimise the damage if any one investment tanks. It's like not putting all your eggs in one basket. This approach insulates you from market swings and potential losses. If one stock craters, others can buoy you up, leading to a smoother ride overall.

DIVERSIFYING CAN ALSO BOOST YOUR RETURNS.

By playing different fields - investing in an array of stocks across industries - you get to score gains wherever they pop up. If tech is hot, you benefit. If energy rallies, you're covered. You get to capitalise on the upside across sectors instead of betting on just one horse. This multi-lane approach can drive higher total returns than a concentrated portfolio.

EQUITY MARKETS ARE NOTORIOUSLY UP-AND-DOWN, BUT DIVERSIFICATION HELPS CUSHION THE IMPACT OF THESE CYCLES.

When one sector slumps, others may stay strong, preventing your portfolio from taking a major hit. While part of your investments lag, the rest keep you chugging along. So you don't feel the full force of the market's fluctuations. Diversification works like shock absorbers for your portfolio's value.

When the market starts shaking like a leaf, it’s easy to lose your cool. But panicking never leads anywhere good, staying diversified keeps you balanced, so you can ride out the storms.

DIVERSIFICATION IS YOUR TICKET TO A FRONT ROW SEAT FOR THE INDUSTRIES AND MARKETS WITH THE MOST HORSEPOWER FOR GROWTH.

By spreading your investments across different sectors and regions, you get to tap into emerging opportunities most concentrated portfolios miss out on. This approach hands you a broader map to explore new investment landscapes.

Diversification also helps you strike the right chord between risk and reward. Spreading your investments across different asset classes allows you to optimise your portfolio's risk-adjusted returns. You can potentially grab higher returns for the same amount of risk, or lower risk for the same returns. Diversification lets you customise your portfolio to match your risk appetite and goals.

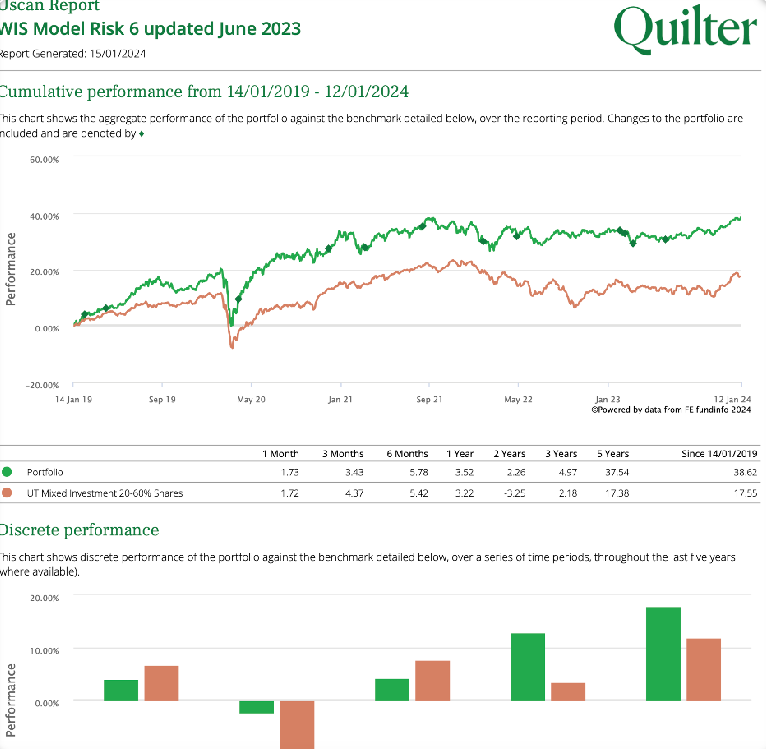

This chart represents our Medium Risk Model Portfolio, which is detailed in green, compared to the UT Mixed Investment 20-60% Shares Index. Over the last 5 years, our strategic asset allocations have outperformed the Index by 21.07%! We are independent, directly regulated via the FCA and use many different platforms. (Source; FE Fund info Jan 2024.)

1 How have we achieved this?

We take a proactive approach to managing your investments, always looking ahead to find the best opportunities. When we see the chance to maximise returns or reduce risk, we act decisively on your behalf. You can count on us to be in constant contact, adapting your portfolio as conditions change.

Rather than just reacting, we anticipate market moves and get you positioned to benefit. We examine the global macro environment, asset valuations, and economic trends to determine where risks are rising and rewards beckon. This allows us to increase volatility up or down appropriately.

Our goal is to capitalise on market rotations and regime changes to capture profits. We'll tilt your portfolio towards the most attractive sectors and regions for the coming year, avoiding pitfalls and chasing upside. With our active asset allocation, your investments work as hard as we do.

2 Is proactive advice what everyone offers?

Our approach to investing is different than most. While some advisers sit back and only make changes to your portfolio every 6 months or even once a year, we take a more proactive stance. We're constantly monitoring the markets, looking for opportunities to help your investments thrive. When we see potential upside, we act quickly to capture it by adjusting your asset allocation. And in volatile times, we make moves to shield your wealth from sudden downturns. This active, hands-on strategy sets us apart. Rather than reacting to market swings, we try to stay one step ahead. Our goal is to give your investments the best chance of success through timely, strategic adjustments. This level of service is unique - we don't take a "set it and forget it" approach. We're keeping a close eye on your portfolio at all times, ready to make the right moves at the right moments. This proactive management could make a real difference in performance over the long run.

3 What portfolios do we provide?

Are you ready to find the investment portfolio that's just right for you? We'll work together to understand your personal tolerance for risk, then carefully craft a customised portfolio that aligns with your comfort level. No more guesswork or generic options - we'll tailor every detail specifically for you. Whether it's an ISA, pension, or general investment account, we'll assess your unique goals and preferences to determine the ideal mix of products and volatility. With our multitude of portfolios for every risk category, we can pinpoint the one that complements your financial personality. The result is an investment strategy that reflects you.

4 How much does this cost?

We have always endeavoured to provide a fair charging policy, one that reduces, the more money we look after. In addition, we don't make any ad-hoc charges for making changes to clients investments, thats all part of our service. We provide an advisory service, so no VAT charges. We'll walk you through any proposed changes, explain why we're suggesting them, and get your green light before doing anything. With us, you always know where you stand, no smoke and mirrors, no nasty surprises, just honest, expert advice to help your money work harder.

5 How often do we monitor your investment?

Have you ever felt helpless as your portfolio plummets during turbulent markets? We get it. Watching your hard-earned savings dwindle is no fun. But what if you had an expert guide through the ups and downs?

That's where we come in. Our proactive advisory service is like having a co-pilot for your investments. We monitor our Model Portfolios daily, so we know precisely how they're performing. If storm clouds gather, we steer you to safety immediately by recommending changes.

For example, when the Fed raised interest rates in January 2022, we pivoted quickly. We disposed of our long-duration fixed income, and repositioned into short-duration funds. Then Russia invaded Ukraine, how did we respond? By adding commodities, world energy, and agriculture funds to capitalise on rising oil, commodity scarcity, and food costs.

Every strategic shift is marked with a diamond on our performance chart. Our most recent was June 23rd 2023, capturing ample upside while dramatically reducing risk.

THE RESULT? SMOOTH SAILING.

We've never had an unhappy client because we contact you at the first sign of trouble. Our vigilance translates into gains for you.

Like what you hear, then contact us here.

Share this post: